Discover the power of Daneric Elliott Wave and how it can transform your trading strategies. Whether you're a beginner or an experienced trader, understanding this unique approach to market analysis can unlock new opportunities for success. In this article, we will delve into the intricacies of Daneric Elliott Wave and provide actionable insights to help you navigate the complexities of financial markets.

The world of trading and investment is vast and ever-evolving, with countless theories and techniques designed to help traders make informed decisions. Among these, the Daneric Elliott Wave stands out as a powerful tool for understanding market trends and predicting price movements. This methodology builds on the foundation laid by Ralph Nelson Elliott, who introduced the Elliott Wave Theory in the early 20th century, but incorporates modern adaptations and enhancements.

As markets continue to grow more complex, the need for robust analytical frameworks becomes increasingly important. Daneric Elliott Wave offers traders a systematic way to identify patterns, anticipate market behavior, and develop strategies that align with market dynamics. By mastering this approach, you can enhance your trading skills and improve your chances of success in the financial markets.

Read also:Movies Rules Your Ultimate Guide To Navigating Rules 2024

Table of Contents

- Biography of Daneric Elliott

- Overview of Elliott Wave Theory

- Daneric's Adaptation of Elliott Wave

- Key Concepts of Daneric Elliott Wave

- Wave Patterns and Their Significance

- Tools for Applying Daneric Elliott Wave

- Case Studies: Real-World Applications

- Advantages of Using Daneric Elliott Wave

- Limitations and Challenges

- Conclusion and Next Steps

Biography of Daneric Elliott

Early Life and Career

Daneric Elliott, a renowned figure in the world of financial analysis, has dedicated his life to understanding and refining the principles of market behavior. Born and raised in a family of academics, Daneric developed an early interest in mathematics and economics. His educational background in quantitative finance laid the foundation for his future work in market analysis.

Throughout his career, Daneric has worked with leading financial institutions, contributing to the development of advanced trading models. His expertise in market dynamics and his ability to identify patterns in seemingly random price movements have earned him recognition in the trading community.

Contributions to Elliott Wave Theory

Daneric's adaptation of the Elliott Wave Theory represents a significant contribution to the field of technical analysis. By incorporating modern computational techniques and real-time data analysis, he has expanded the applicability of the original theory to contemporary markets. His work has been widely adopted by traders seeking more accurate and reliable methods for predicting market trends.

Below is a summary of Daneric Elliott's key details:

| Full Name | Daneric Elliott |

|---|---|

| Occupation | Financial Analyst and Trader |

| Field of Expertise | Elliott Wave Theory and Market Analysis |

| Notable Contributions | Modernization of Elliott Wave Theory |

Overview of Elliott Wave Theory

Elliott Wave Theory, originally developed by Ralph Nelson Elliott, is a form of technical analysis that identifies patterns in market behavior. At its core, the theory posits that market movements follow predictable patterns, which can be broken down into waves. These waves reflect the collective psychology of market participants and can be used to forecast future price movements.

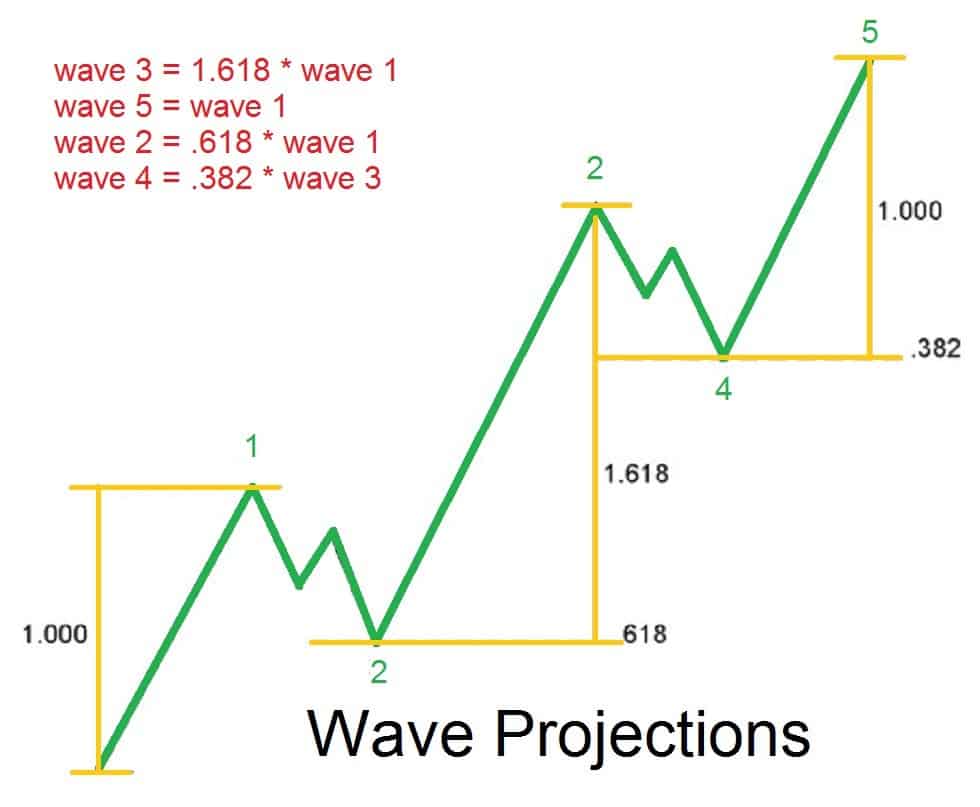

The theory categorizes waves into two main types: impulse waves and corrective waves. Impulse waves consist of five sub-waves and move in the direction of the larger trend, while corrective waves consist of three sub-waves and move against the trend. By understanding these patterns, traders can better anticipate market movements and adjust their strategies accordingly.

Read also:Hdhub4u In Hollywood The Ultimate Guide To Understanding Its Impact And Influence

Daneric's Adaptation of Elliott Wave

Daneric Elliott Wave builds on the foundation of the original Elliott Wave Theory but incorporates modern elements to enhance its effectiveness. This adaptation addresses some of the limitations of the traditional theory, such as its reliance on historical data and its susceptibility to subjective interpretation.

Key features of Daneric's adaptation include:

- Integration of real-time data analysis

- Use of advanced computational algorithms

- Incorporation of psychological and behavioral factors

Key Concepts of Daneric Elliott Wave

Wave Patterns

Daneric Elliott Wave focuses on identifying specific wave patterns that indicate market trends. These patterns include:

- Impulse Waves: Representing the primary trend

- Corrective Waves: Reflecting market retracements

- Diagonal Waves: Occurring at the start or end of a trend

Market Psychology

Understanding market psychology is crucial to applying Daneric Elliott Wave effectively. Traders must recognize how emotions such as fear and greed influence market behavior and contribute to wave formations.

Wave Patterns and Their Significance

Wave patterns in Daneric Elliott Wave provide valuable insights into market behavior. By analyzing these patterns, traders can identify potential turning points and adjust their strategies accordingly. For example:

- Impulse waves indicate a strong trend, signaling opportunities for traders to enter or exit positions.

- Corrective waves suggest market retracements, allowing traders to prepare for potential reversals.

Tools for Applying Daneric Elliott Wave

To effectively apply Daneric Elliott Wave, traders can use a variety of tools and resources:

- Charting software with wave analysis capabilities

- Real-time data feeds for monitoring market movements

- Algorithmic trading platforms for automating analysis

Case Studies: Real-World Applications

Several case studies demonstrate the effectiveness of Daneric Elliott Wave in real-world trading scenarios. For example:

- A trader using Daneric Elliott Wave identified a potential reversal in the stock market, allowing them to profit from a timely exit.

- Another trader applied the methodology to the foreign exchange market, successfully predicting currency movements and adjusting their positions accordingly.

Advantages of Using Daneric Elliott Wave

Daneric Elliott Wave offers several advantages over traditional trading methods:

- Improved accuracy in predicting market trends

- Enhanced understanding of market psychology

- Flexibility in adapting to changing market conditions

Limitations and Challenges

Despite its benefits, Daneric Elliott Wave does have limitations:

- Requires a strong understanding of market dynamics and wave patterns

- Can be subjective, depending on the trader's interpretation

- May not account for unexpected market events

Conclusion and Next Steps

In conclusion, Daneric Elliott Wave represents a powerful tool for traders seeking to improve their market analysis skills. By understanding the key concepts and applying the methodology effectively, traders can enhance their ability to predict market movements and make informed decisions. To further your knowledge, consider exploring additional resources and engaging with the trading community.

We invite you to share your thoughts and experiences with Daneric Elliott Wave in the comments below. Additionally, feel free to explore other articles on our site for more insights into financial markets and trading strategies.

Sources:

- Elliott, R. N. (1938). The Wave Principle.

- Prechter, R. R. (2003). Elliott Wave Principle: Key to Market Behavior.

- Daneric Elliott's official website and publications.